Dear Friend

Well, don’t say we didn’t warn you but are you ready to pay your bank or building society for the privilege of it looking after your money? Negative interest rates might be on the way. It is bad enough receiving ‘nothing’ but then, aside from your emergency money, you ought to invest in ‘proper things’ anyway with your main cash deposits. Our ‘Balanced’ strategies can still generate an initial income yield in the region of 4%pa and with capital growth potential too (as well as increasing income) so there are options for investors after all.

Investment Opportunity

So, if I told you there was a fully quoted, multi-billion, diversified investment fund out there paying a dividend of over 4%pa yet where you could have bought its shares at a 60% discount to the underlying asset value of the whole portfolio, would you believe me?

Our clients believe us, as we hold it and have been nibbling-away for a little while now. It’s an eclectic bag of assets and maybe there are some things in there where it would be difficult or impossible to realise that full value but there’s plenty of protection in there for that and some worth more on sale too. To be frank, it is a surprise that the managers haven’t decided that it is time to take it private and keep all the spoils for themselves. If it was priced at 100% of the assets, in today’s market that may be a bit rich and I guess we’d have moved-on already but the joy with this type of investment is that regardless of whether its assets go up or down in price, there is a technical trading opportunity in there for ‘free’. If that discount narrows to say 30% because there are more buyers than sellers (and the Fund has been buying-in and cancelling its owns shares as that’s a great investment return for it anyway!) then that means all our investors have had an uplift, a return from the ‘worst’ discount, of 75% (yes 75%!) just because of that opportunity – can you imagine that? If it doesn’t happen, does it matter? Not really, for our 40p we have been enjoying the returns on £1’s worth of underlying assets and as sure as eggs is eggs, if the market doesn’t correct this vast anomaly, then some corporate activity will do it as it is too attractive to a ‘raider’ to stay this way for ever.

Or what about another Investment Trust where the shares are for sale at a 31% discount to the underlying asset value (so at 69p you buy £1’s worth of assets – all listed companies and bonds) and where a potential name change could elevate it up into the ‘popular’ stakes (and a premium to that asset value instead)? Since 5 November, simply through its stock selection, the underlying asset value has risen a remarkable 49% and as soon as private investors see this short-term result they will start to buy and push the price up further. We already have baskets full of the stuff… I bought some more this morning though!

I raise this not only to show what can be available and the sort of things we are seeking all the time for all our clients but also to note that if you are not with us, the chance of your adviser or your manager having these is pretty non-existent. Sadly and without trying to be arrogant but most don’t understand quoted funds nor do they have the scope of holding them for clients either. There’s no special reason why I’d buy these over something else except for the fact that if we think it is the ideal thing to enhance our clients’ returns, (including the income so many of them enjoy from their capital with us), then it can be bought and held till it’s time to move-on (that’s our decision too). We don’t receive kickbacks, commissions or fees from what we buy – we’re totally independent – anything is a possibility to be included after we have screened it, yet even then, no single holding ever counts for a significant exposure in the overall funds we manage. That spreads risk and increases opportunities we can pursue and well, there are so many different stories for things which excite us at the moment. For example, how about a Residential Property Fund which invests in leaseholds and pays a dividend income of over 6% and where the shares have fallen by 44% over the last few years? We’re sniffing-around because it has popped-up on our radar. We never had it before when it was popular… And don’t forget – there are no subscription fees to add money to our systems either, unadvised.

Cheap Pharmaceuticals

Yes, you would have thought that with all the activity in the pharmaceutical sector over the last year that the global giants would be doing very nicely with their potions and pills but it is not really the case. Of course there is more to it than that but investors have preferred to chase the speculative medcos, the ‘do or die’ ones – those which rocket if they happen to be the one in a hundred which actually brings a new process to market (conveniently forgetting all the others which fizzle away and run out of development capital).

Last week, GlaxoSmithKline shares dropped to a ten year low to levels first seen in 2005 in fact. The Company’s still committed to its dividend which is equivalent to 6.2%pa. You can imagine, we are buyers at these levels and not sellers. It’s dull, boring, staple and well, it’s not going away even if all companies and sectors hit harder times than others. What many investors forget too is that sectors come and go in favour. This one (like oil) is out at the moment. Tech is ‘in’. One is cheap… the other is exorbitantly dear. Investing often is about knowing what to avoid too – or simply put, if you want to put money in Glaxo you have to find it from somewhere else and if it is in Glaxo, it’s not in that ‘something else’ either. With our fears for the over-exposed sectors, you can see why we secure comfort in such stocks and sectors as these, which will still do nicely upon our return to economic reality and possibly where the shares could enjoy a rerating to see them double and all from what could be considered as one of the lowest of risks going at the moment, especially compared to some dreamy tech company which has yet to make a real profit…

Remember what I have said before too – ‘value’ situations which are too cheap and where the market won’t reflect an appropriate value for their shares are also targets for takeover by others. We have had several such bids over the last year and all add extra value for ‘nothing’. The latest is Aggreko – thank you very much. Not every client has each one of course but a good cross-section is in there for ‘free’ so well done if you happen to score! What does surprise me is that there haven’t been more but so often, institutional money prefers to chase the expensive stuff on unjustifiable expectations as it is easier to raise new investor money for those… daft eh?

Understanding Risk

None of us will understand fully all the nuances of ‘risk’ Sadly in life, politics and global economics it is often the case that the biggest risk of all is the next big bad thing that goes wrong that we didn’t imagine ever would cause us that cost or damage either. We never even thought it was a risk or we thought it was as ‘safe as houses’.

How do we better deal with risk? First, we have to recognise and accept that it exists and then we must manage it. There is no such thing in life or investments as ‘no risk’. Indeed, it can be a very big risk if all your money has no opportunity of growing in value and instead is affected by just a couple of economic factors like interest rates or inflation eating it up (or maybe minus interest rates eating away your deposits every year, so on each statement you see your balance shrink!). There is also the ‘opportunity cost’ – what could you be receiving instead if you did something else – at least with a bit, even if not ‘all’?

I enjoyed watching Alistair Campbell’s documentary on his Depression – not a nice condition but he visited a specialist in Toronto and she introduced him to the ‘Jam Jar’ and that analogy can work with ‘risk management’ too. The picture is that the jar has certain genetic features (pictured as ‘balls’) in it when we are born but as life progresses, we add experiential balls to that jar – stresses, if you like. If the jar fills-up and explodes – that is mental illness and breakdown of some form. However, there is hope in that the specialist said that we can all extend the neck of the jam jar, its height and thus available space, by doing positive things, such as not drinking as much alcohol, doing regular exercise, having outside interests, helping others, having a pet, engaging with friends and family and other ‘positive things’ and so then we have made extra space to better enable us to manage the stresses which life throws at us.

I am not an expert but being able to manage ‘risk’ could be seen similarly and yes, we can learn more about it and how it affects our finances, how we must move our emotional and often irrational behaviours too from the process, even if we take small steps to start. Remember too, we take risks because we believe the outcome will be of greater benefit than not taking that risk. Previously I said we rise from bed, we use electric to boil a kettle, light a fire for warmth, jump in our cars on dangerous roads to go to work and so on – all because we aim to achieve an outcome which surpasses the risks each activity represents to us. Investing is like that though of course there are different degrees. We don’t gamble on the latest horse race with all of our clients’ money either – and we use myriad methods and systems to diminish the risks as much as we can yet not missing opportunities we need to be pursuing at the same time (like the ones above).

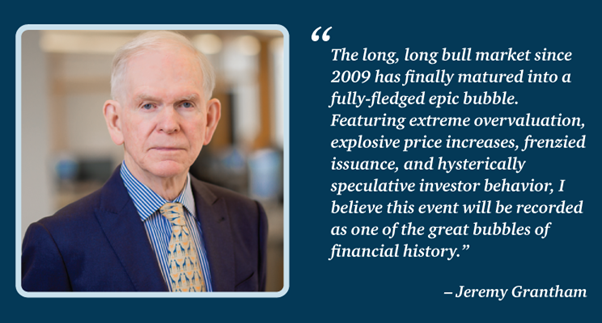

Bubble Mania?

I’m not quite as bearish as he is but we’re avoiding all the over-valued stuff… he does talk much sense and his firm is not unhappy about losing clients who disagree with that synopsis. He reminds investors too of the flow of dividends and succinctly says that if Bitcoin is valued on the dividend flow then its price is zero… remember, in my mind Bitcoin is not an ‘asset’. It does not exist but it has been one of the most successful marketing ploys of all time and the ‘greater fool theory’ has been worked out here to its best possible effect ever.

Funeral Plans

Just had an unsolicited call trying to sell me funeral plans yesterday. So the response ‘I don’t like them because they are not fully regulated and unnecessary in most cases’ was met politely (off the standard script) by: ‘Oh but they are sir. They are fully regulated by the ‘FPA’ (sound a bit ‘familiar?) which of course stands for the Funeral Planning Authority (not the Financial Conduct Authority). ‘But the funds aren’t protected’, says I. ‘But yes they are sir there is a £400million Trust fund.’ ‘But they and it are not regulated and protected by the FSCS and if something went horribly wrong people could lose all or part of their money as that Trust fund is not regulated.’ ‘But that can’t happen sir, it is all in a Trust fund backed by the big companies like Dignity – you have heard of Dignity? All the funerals would be covered whatever happened’. Really…

It is WRONG. And do we know why these guys are upping the marketing like mad? Because the Regulator, the proper regulator, the FCA, is bringing-in imperative regulations and what else? The average commission for selling one of these things (plans which most people don’t want or need) is £800.

The FCA should ban the sale of these things NOW and resumption only when the new regulations are introduced.

Risk Warning

Stock market investments can offer income through the payment of dividends and interest and good opportunities for capital appreciation over the longer term. By this, generally we mean periods in excess of five years, preferably much longer. However, we can never promise you particular returns, especially in the short-term. At any point in time but especially in the short term, your capital could be worth less than the original amount invested as some of the selected holdings may fall in value, regardless of expectations at the time of acquisition. We may also invest in funds that hold overseas securities. The value of these investments may increase or decrease as a result of changes in currency exchange rates. Returns achieved in the past cannot be relied upon to be repeated.

To remind you, why do I send out occasional emails? Because everyone can save money. We have no connection with any companies mentioned and you have to make your own contacts and satisfy your own enquiries. What is in it for us? If we can prove that we are knowledgeable and that our service and advice have good value, then you might contact us for professional financial planning and investment help. You don’t have to do that though and there’s no charge for emails. If simply they save you money, then accept them with our compliments! However, you’ll know where we are!

If you have any queries of any form or indeed any subjects you think I could include, please contact me. I also refer you to our website www.miltonpj.net. We celebrate our 35th anniversary in 2020 and have been publishing a well-respected independent column in the local Paper for most of that time and free client newsletters as well.

Do not forget however the usual caveats – this is not ‘advice’ and you are encouraged to seek that before embarking upon any financial route involving investments, etc.

My best wishes

Philip J Milton DipFS CFPCM Chartered MCSI FPFS FCIB

Chartered Wealth Manager

Fellow Of The Personal Finance Society, Fellow Of The Chartered Institute Of Bankers