Sorry but time is running-out for us to be able to help you and as we are so ludicrously busy but if you haven’t done what you should have done before the end of the Tax Year, it is now or lose it! If you are not sure, please don’t ring but reply to this eshot and we shall revert to you as quickly as we can. Remember too, down the line tax rules are likely to be much nastier so ring-fencing what you can whilst tax rates are generous is likely to be wise! We can take money up till only 31 March this year as Easter is right after!

1. Have you used your ISA Allowance yet (£20,000 each)? If you have lots of capital and are in the ‘Must’ camp rather than the ‘that’d be nice’ camp, then make sure you do it!

2. Have you optimised your Personal Pension contributions. Even if you are in a company or State scheme, you can pay-in more and every £1 you contribute to a personal pension is boosted immediately by 25%! If you are 55, you can have instant access to it too (of course it may be foolish to do that)! If you pay 40%+ tax then you receive extra relief!

3. If you are under 75, even if you have no earnings and are not working, you can contribute £2,880 to a Personal Pension and the Taxman will give you £720.

4. If you have sizeable assets, pregnant with chunky, taxable gains, make sure you use your full CGT allowance which is £12,300 each.

5. If you have significant capital and Inheritance Tax is an issue, have you made donations to family and friends? Don’t forget too you can invest for say grandchildren and we can set-up a collective pot for you where you still control the capital and its access.

And don’t forget either – with pensions and ISAs, make your investments EARLY in future years, so repeat the exercise on 6 April! (Remembering too that subscriptions to our strategies cost absolutely NO initial fee, NO commission and NO advisory charge either). Full details of any and everything will be sent to you of course and full terms are on the website. We now manage over £205million for people just like you. The fair management fee we receive for looking after and managing that pot is what pays most of our bills and allow us to have such attractive terms for clients and subscribers!

Performance And Costs

Investors quite rightly consider these questions. They seem logical and data upon which they can make judgements. However, there is infinitely more to it than a two-dimensional reply! The best investments to buy are the most unloved as they are the cheapest and the ones to sell are the over-loved… Before anything else, do have another look at our last newsletter for more information of recent outcomes but as we try to say to all our clients and prospective clients, it is always, even then, the future which is important and not the past. What we acquire and hold for clients today is what is imperative and as ‘Value investors’, today that does not include many of the momentum plays which most investors hold elsewhere – but it has not done us any wrongs and will continue to protect us against excessive risks in over-extended stocks too. So, if you want Tesla and Bitcoin (a non-existent ‘asset’) today, we are not for you! I am afraid that we shall be most unlikely to repeat our very recent performance but we shall always try – that is as ever our one core promise and guarantee! We shall also try our best to avoid any likely unwinding in the excessively over-valued areas too.

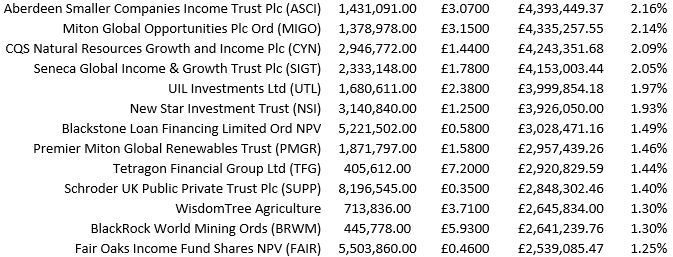

However, something we do rarely but here is a snapshot of our present largest exposures across all client types and none:

The percentage at the end is the proportion of our total assets as we believe in absolute diversity. We hold some direct stocks of course but they feature further down the list after we have a core of others’ funds (so we rely upon their performance rather than our own)! I should add too that most of these are ‘there’ because of their phenomenal gains in that we are running over-weight positions. For example, the Seneca Trust went as low as £1.10 and is now pushing £1.80 (as well as a 4%+pa income) and I escalated our buying from the silly people panic-selling this rather safe and diversified Trust, acquiring as much as we could – we have just reported we own 6% of the whole Trust now.

Amongst others we have also sold at significant prices in the last several months (so no longer showing in the list!) Alternative Credit Investments (takeover), G4S Plc, Kin and Carta Plc, PZ Cussans and D S Smith. We have also significantly trimmed our exposure to Black Rock World Mining, ICG Enterprise, North Atlantic Small Companies, Canadian General Trust and CQS Natural Resources, all having rocketed this last year. Do google one or two of these names’ performances though as I say, it is what we hold for the future which is the most important! We had no exposure to Mr Woodford either but do now own (as you can see above as our tenth biggest stock) over 8million of his old Investment Trust (now Schroder). We chased that all the way down to the bottom! It still trades at a significant discount to the likely underlying asset value as well.

St James’s Place

A curiosity has happened! Helena Morrisey is leaving the board of SJP after only a matter of months in post. Before she came, she had acknowledged the high and hidden charges the group levied across all of its customers and especially when they contribute fees of up to 6% taken in costs and ‘commissions’ to the salesman. “I have not met anybody yet who can completely articulate how it works in a sentence,” she told the Daily Telegraph in the weeks before she took up the role. “I would like to satisfy myself that fund charges are transparent and fair, but I do not believe they are transparent because otherwise I would be able to explain them to you very quickly.”

Now she’s left (we assume after being unable to explain the high costs after those fourteen months…) she’s moved to a rather different operation and she has shared:- “Its low cost, easy to use investment platform is exactly what people need to help them start their investing journey and build financial security for themselves and their families.” So now she likes low cost. Wags have been wondering if she’ll now suffer the up-to 6% penalty on withdrawing her money from SJP.

Just for comparison, we don’t take a penny in ‘subscription charges’ and if you don’t need our specific professional advice and subscribe ‘Execution only’ to our unrivalled and cost competitive managed strategies, there are no advisory fees to join our happy Club of contented clients either.

Peer-To-Peer Lenders

Remember our regular warnings? Buy 2 Let Cars Ltd’s called-in the administrators. It is not only that the figures didn’t add-up but when administrators are involved, they will liquidate things at whatever they can secure and the costs of the administration can be immense.

Please be wary if you are depositing money with any Peer-to-Peer lender which does not provide regulatory protection (most don’t), as it is too late when… it is too late. I have commented on many in these pages and even been threatened by one local one… Conversely, we have done very well from holding Funding Circle Plc shares but that is different – they went down to 20p last year and since have been as high as £1.42 and we also buy collective quoted loan funds but that’s different!

How Ethical Is Your Investment Provider

I have commented on this a few times in the past. I think the Black Rock ex-ethical investment chief has been reading what I have been writing! In a nutshell, we all want to ‘do some good’ (well, or not do some bad) with what we want to do with our money and that is a noble consideration. However, as this article says, possibly the marketing hype and opportunity for lots of people to become very rich on spinning an artificial solution, it’s not all it seems to be:

This isn’t just ‘green-washing’ either but downright deceit, let alone ‘convenient truths’ or ‘mistruths’ as are so often promulgated by those peddling ‘ethical (‘ESG’) investments as the latest ‘must have’. No, I am not in any way attacking anyone’s best endeavours to invest wisely in all regards but do they all really know what they are buying and not only that, but are they doing the worst thing of all which is simply salving their consciences so they don’t have to think about it anymore, don’t want to be challenged as to whether they are ‘doing good’ either (not only in how they invest but how they spend and the businesses they support in their daily lives too)? It is an interesting topic and so far, the UK has not adopted the EU’s naïve requirement upon advisory firms to pursue this concept blindly just simply because it ‘sounds good’. Yes we have solutions but some investors may not like the honest inferences when they look more deeply into the whole concept. (We have also created a charitable foundation – so in ‘ethics’ that stands head and shoulders above what for many entities is simply another money-spinning sales’ idea).

Do You Trust Your Financial Adviser

A recent survey suggested many Brits don’t.

The funny thing is that most of our engaged clients trust us tremendously so what’s wrong with so many people out there?

Have they had a bad experience, been defrauded by a scammer or perhaps they have chosen badly and been flogged something for ulterior motive? (Thankfully the latter happens much less since commission was scrapped in 2013 but some firms still take commission of up to 6% on investment products and dress-it-up as ‘fees’ and when other direct selling entities like NFU Mutual look to engage new sales’ people with promises of way over £100,000 annual sales’ reward, you know it’s because they are selling the wrong sort of stuff to unsuspecting customers. It smacks of how Equitable Life used to dress-up the fees for its marketing staff, you know, ‘we pay no commission’ – pshaw!).

Of course, with some people, it is life too – they only trust to the extent that they believe they can be trusteed themselves… that’s an interesting one! However, please don’t be foolish, don’t be naïve, do some base checks before you engage an independent financial adviser, check the quality of what they say and listen to the guidance and weigh it. Then don’t be foolish with what you buy or how you send the money etc! If it’s something esoteric and not mainstream, it’s not going to be for you and it’s not an investment to buy a holiday lodge, hotel room part-ownership in Cape Verde Islands or loads of other similar scams.

Finally, when you find a good egg adviser, cherish that relationship as the firm has your best interests at heart – they may not be perfect and it’s still your money which goes up and down but their long-term interests and your and your Family’s long-term interests. What peace of mind such personal connection is – priceless!

Compensation – Ex-Organic Clients

You will recall we have been helping as many of these clients as possible to claim the compensation due to them. Most clients we have encouraged to ‘do it themselves’ and certainly not to use claims’ chasing parasites which steal so much of the money due rightfully to them. However, the sixty-nine clients (out of around 1,600) who have decided it needs doing by us formally have so far had over £2million of compensation awarded and our bill for that? 1.3% of the compensation with an average of just £377. Have we charged anyone who failed to secure compensation? No – all of our cases have been assured of payments and we have not charged anyone for abortive work so they have all not risked anything by engaging us. The quickest claim from start to finish was £55,383.78 in just fifteen days! The slowest with all sorts of hassles and problems totally outside of our and the client’s control took 433 days. If you have yet to claim, please contact us. The median is just over two months to the cheque. We are still working on eighty-nine in the pipeline yet!

A Brexit Benefit

The inane ‘10% drop’ letters demanded by the EU rules are being reviewed by the FCA and are likely to be dropped. This insisted that a specific letter was sent to investors within twenty-four hours (only in discretionary services so not advisory services (which was just as stupid to omit them!)) if a 10% drop since the last contact had arisen. All discretionary managers had to produce these last year. What would be more sensible would be something like ‘all financial advisers and investment firms eliciting direct investments must write to their investors in general terms when a market shake-out happens, to keep them in touch and to advise them of contact information if they are concerned.’ Of course the good firms did that anyway and frankly, if yours didn’t then you need to change firms – it is as simple as that. We worked the hardest we have ever worked during the darkest days with many communications and that is what you should expect of your adviser/manager. We saved an awfully large number of people from doing the wrong thing at the wrong time too – and encouraged many to do the opposite and wow, aren’t they now looking clever with their stupendous gains we have enjoyed with them! Remember my earlier article too where most managers and clients elsewhere who fled to cash then were still holding cash, even when most of the rebound had already taken place – that’s worse than enduring the pain for a bit longer – crystallising a real loss from a paper one which has since evaporated.

Risk Warning

Stock market investments can offer income through the payment of dividends and interest and good opportunities for capital appreciation over the longer term. By this, generally we mean periods in excess of five years, preferably much longer. However, we can never promise you particular returns, especially in the short-term. At any point in time but especially in the short term, your capital could be worth less than the original amount invested as some of the selected holdings may fall in value, regardless of expectations at the time of acquisition. We may also invest in funds that hold overseas securities. The value of these investments may increase or decrease as a result of changes in currency exchange rates. Returns achieved in the past cannot be relied upon to be repeated.

To remind you, why do I send out occasional emails? Because everyone can save money. We have no connection with any companies mentioned and you have to make your own contacts and satisfy your own enquiries. What is in it for us? If we can prove that we are knowledgeable and that our service and advice have good value, then you might contact us for professional financial planning and investment help. You don’t have to do that though and there’s no charge for emails. If simply they save you money, then accept them with our compliments! However, you’ll know where we are!

If you have any queries of any form or indeed any subjects you think I could include, please contact me. I also refer you to our website www.miltonpj.net. We celebrate our 35th anniversary in 2020 and have been publishing a well-respected independent column in the local Paper for most of that time and free client newsletters as well.

Do not forget however the usual caveats – this is not ‘advice’ and you are encouraged to seek that before embarking upon any financial route involving investments, etc.

My best wishes

Philip J Milton DipFS CFPCM Chartered MCSI FPFS FCIB

Chartered Wealth Manager

Fellow Of The Personal Finance Society, Fellow Of The Chartered Institute Of Bankers