Dear Friend

I hope you have had a good Easter – the weather was lovely – albeit chilly as well. It is great too to look to the future – and hope in so many quarters and won’t it be nice to be able to think about going out and even wining and dining again even if outside to start! Anyway, I hope that you find something of interest here and as before, if you wish to reply to anything as a result of what is here, so we can best manage things please do so to this email address and NOT to any individual as such – thank you.

Use It Or Lose It (II) – Buy Whilst Stocks Last! – (And The Worst Year For Cash ISAs On Record)

Well of course the markets will never run-out of stocks but for us, after what will have been the best performance year for clients since the Firm was established in 1985 (even for the lowest risk clients with purely high security, defensive assets in their pots) following the mires of the Pandemic’s economic impact last March, it is harder, yes, finding things at such ludicrously low prices and values as there were then. We have achieved this recovery and result, too, primarily by avoiding US tech which in our view is even more over-blown (and the US generally) which has been in bubble territory for too long. Even chartists are now pointing to the US’s wedge shape performance chart as a very bearish signal. What is likely though is that any reality check over there will have limited impact on ‘value’ over here though as ever, we are diversifying as far and wide as we can and with uncorrelated assets which won’t be affected or indeed should rise as those stocks fall.

If you are in the ‘must’ camp of those who need to use ISAs, please fill yours now. If you need a form, please contact us! The more time you are invested, the better the tax benefits and fewer hassles you’ll have otherwise scrambling to do something just as the tax-year ends. You can pay into your Pension if eligible too. Do we buy investments which are too dear? No – we are looking constantly for ‘good value’ holdings and sectors and our universe remains very attractive, even if there is no way we can replicate 2020/21’s results – sorry! This includes still being able to generate a very good natural income from a very wide basket of securities, giving in the region of 4%pa regardless of what the capital does short-term. The income does not impact our sensible-term expectations for the portfolio either, for capital preservation, growth potential and indeed, an increasing income as well.

And yes, whilst the average market ISA rose 13.5% last year, the average Cash ISA gave savers (not investors!) a paltry 0.63% and not even matching inflation according to ‘Moneyfacts’. With the Bank Base Rate even lower at 0.1%pa now, 2021/2 is likely to be worse. The good thing is you can transfer a Cash ISA to one of our Market ISAs (and we have a High Security, High Income option too for the more risk averse).

Ethical Investments And Sanctimony

It has been entertaining to see a number of institutions eschew the ‘Deliveroo’ flotation because of apparently inappropriate social governance policies. Of course I shouldn’t be surprised if these same managers are the ones ordering their take-away food using the service mind you… it all sounds very much like grand-standing or virtue-signalling if you ask me. What about all the other tech companies they are happy owning as nicely ‘ethical’? Are they just trying to jump upon the bandwagon for publicity? Have their sold their stakes in Uber for similar alleged practices (and look how hard that company is balking about having to treat its staff as employees).

I have a Facebook account and was amazed to see that Company’s acknowledgement of closure of billions of fake accounts the last few years alone. When we realise Facebook has gotten rich by selling advertising, based on clicks and reach and it has told its advertisers (taking fat sums from them) reaching non-existent people in their billions, all very ethical. And did you know that despite clear ethical failings there are some things you can’t do as there is no way to report them, regardless of the abuse which may be involved?

Let me give you an example. There may be a local group where you are not a member but where you are made aware by someone that you are being defamed upon it by other members. You cannot complain as there is no way to report it. You may even have seen and recorded the abuse from someone else’s page but there is nowhere you can report it to their ‘we are a very caring organisation’ caring department. Indeed, Facebook has even now said that posts calling for politicians to be killed are quite acceptable, so that’s nice to know. Would you like another? So, a deceased account, a dear friend of mine, her page is still there and it has been hijacked by a fraudster. So how do you inform Facebook of that? You can’t. You can report the ‘post’ or the ‘message’ but if that isn’t offensive in itself, Facebook does absolutely nothing about it. And now recently my ‘messages’ box is being filled-up by lewd accounts wanting to be my ‘friend’ in exchange for sexual favours. Can I turn these immoral and unsolicited approaches off? No and no way of reporting them.

Then what about Tesla which now ‘invests’ in Bitcoin. It’s very ethical by being a green energy company of course but Bitcoin ‘miners’ are consuming vast amounts of electricity with not an ounce of environmental offset or benefit.

So you are trying to believe in environmentally or socially responsible investing (ESG)? I am sorry to say but you have been and are being sold a pup by people who are getting very rich on your money as your ‘Ethical’ investments are full of this sort of unethical stuff and these aren’t alone.

Anyway, Deliveroo slumped on its launch – a 30% drop from the issue price but still at a ludicrously high valuation for a Company which could not even make a profit during perhaps what will prove to be its busiest ever year – the pandemic. There are and were still plenty of institutions which supported the Company – but the cynic would say ‘it’s ok, they sell ‘ethical funds’ as well.

Woodford Investors

Yet another kick in the teeth for the aggrieved Woodford investors. One of the biggest unquoted assets in the portfolio, Oxford Nanopore, is finally preparing itself for a mega-listing. That is something else which Woodford investors could have enjoyed as opposed to the bungled liquidation after the funds’ suspensions. I have said it before and shall say it again – the earlier issues were one thing but in my view the handling afterwards has been even worse and more disastrous. Link had all capacity of offering investors a variety of immediate options and one of those could have been for investors to have held-onto the various parts of the portfolios had they wanted. Our clients will do very well out of this latest float – we bought into the old Investment Trust (whose shares have doubled since their low) and also one of Mr Woodford’s largest other direct holdings which also bombed as it was dumped – IP Holdings. We never held any of the original funds and tried our hardest to dissuade anyone from supporting his new venture and especially the launch of what was the largest Investment Trust at the time – Woodford Patient Capital. All that said, we do not support the claims against Hargreaves Lansdown where ‘advice’ was not provided and where no fee was paid in exchange for endorsement. Those who subscribed from a ‘Best Buy’ list did so on their own heads, just as if they take any newspaper tip or whatever too – you can’t have it both ways.

And now Link – which sold a big basket of unlisted stocks at rock bottom prices to Acacia, a quoted US company (one which then turned many of them over at a vast profit almost immediately), has now said it didn’t know that Neil Woodford was connected to them. Strangely enough, when Mr Woodford announced he was going to create a new biotech investment company in Jersey, it was in liaison with Acacia and the initial stocks would be formed by this tranche of remaining holdings acquired from Link. Ouch.

Green Investments

Remember I mentioned about the money flooding into ‘Clean Energy’ and how it was so disproportionate that two tiny New Zealand companies have seen their companies’ valuations explode, simply because such an unfettered torrent of cash has been subscribed without any checks or balances (talking billions in total)? Well, Black Rock now has to consider restructuring two mega-index funds (a bit late!) and at some point soon, colossal chunks of these tinier components will be flooded onto the market and guess what… where’s the market going to be to buy them? This really is one of those things that what seems like a good idea by the naïve can go horribly wrong… watch this space and I hope you aren’t involved – our clients certainly aren’t. It does sound like one of those very profitable opportunities though – anyone short-selling those shares before the restructure could see guaranteed profits underwritten by all those investors, as they’ll be able to buy the shares back-in to meet obligations at what could be a fraction of the price you secure today. Check-out the graph:

https://www.blackrock.com/us/individual/products/239738/ishares-global-clean-energy-etf

It’s not the only such ‘fund’ of course. Do you really know what you are doing with your investments?

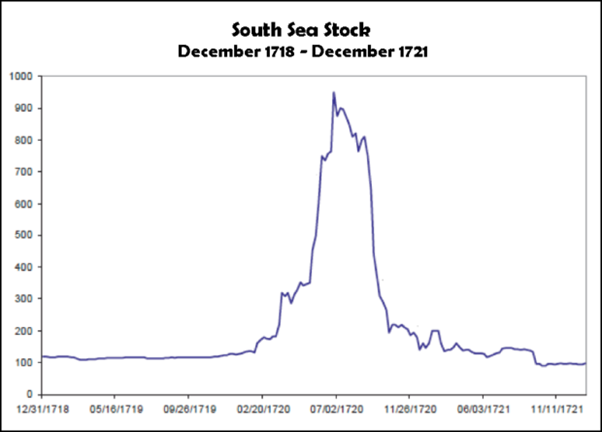

All this behaviour, US tech, Bitcoin, Green energy… last week I attended a lecture on the South Sea Bubble, which imploded in 1720 (three centuries ago, to the year…). Frighteningly there are parallels despite our apparent knowledgeable experience and expertise now, to avoid repeating such obvious mistakes. What is perhaps less well known is that the original company started to make a fortune prior to this episode and from trading in slaves from Africa. As if the recent resurgence of interest in slavery and the ‘legacy’ from those trading in it were not big enough portents to warn today’s investors…

Still, I repeat to our investors… we don’t have any. We’re looking to offload our overblown green energy exposures (bought when no-one was as worried about the opportunity) and we have effectively ‘no’ US Tech and certainly no Bitcoin (which doesn’t exist of course, has no proven stable ‘use’ and which has no State backing and tax-raising powers as ultimate support). It is also funny that ‘this’ is all happening as the price of gold is pointing downwards again… we sold all ours because we felt a drop was overdue and also to raise the money to buy better value things which we believed would go up – we won both ways.

https://www.dailyfx.com/forex/market_alert/2021/03/30/Gold-Price-XAUUSD-Slumps-as-US-Treasury-Yields-Hit-a-Fresh-14-Month-High.html

Is this a sign of higher inflation coming the world’s way? It is if you believe US Treasury yields so watch-out what will happen to your cash balances… Gold has plumbed levels first seen last April on the way up – now down 17% from its peak. Rubbing salt into the wound but look at the opportunity cost (what you could have earned if you were otherwise invested) – take say the FTSE250 Index – it is up 32% since then and has also paid an income so that’s a ‘loss’ of over 50% from your gold.

Following-on from the theme but the Lex Greensill affair and Mr Gupta’s steel loans… (it sounds like something out of Gotham City) but you may not have seen the collapse of a big speculator in Chinese Tech (amongst other things) Archegos –

https://markets.businessinsider.com/news/stocks/archegos-hedge-fund-liquidation-wall-street-credit-suisse-nomura-goldman-2021-3-1030254463

Big banks have allegedly lost tens of billions in loans which all worked well when the investments kept spiralling upwards but then whoosh – it’s all gone and their loans with it.

And just for an update but the ‘safest of safe’ investments, US Government Treasury Bills have not only seen their yields more than treble in just seven months (to 1.74%) but on the rolling, total return basis (Barclays US Long-dated Treasuries TR Index) they have had their worst ever one year loss (-17%). So, remember that when you say you want the lowest possible risk… and if you are full of Government Bonds or trendy ‘Lifestyle’ Investments, just be very wary about what you really have! We have zero exposure to these. ‘Lowest risk’ investors elsewhere have buckets full of these sorts of ‘safe’ things…

Big Investment Institutions

We have been investing in a small quoted company for a very long time so know intimately the ins and outs of what has been happening. So we know who are the other major shareholders, chat to the Chief Executive and so it goes on. Yes, it’s still a recovery play and a long, drawn-out affair. It’s quite hard to buy or sell meaningful quantities of the stock and major supporting shareholders own a good chunk anyway. However, none of that matters. But in March, one of the other long-term institutional investors decided to sell its shares. Now wouldn’t you imagine that big, professional managers, would know how to trade investments both in buying and selling? If you own a big quantity in comparative terms, what you don’t do is simply go to the market makers and take the first fire-sale price for ‘helping you out’. What you do instead is make a few enquiries, perhaps of the Company itself and if it can’t help, some of the other big shareholders who may be willing to acquire your stake. You do this for a couple of reasons – the first is to not destabilise the Company’s position and share trading position (if you have integrity) but more importantly, because you expect to secure a better price for your investors. It doesn’t matter if the ‘fund managers have changed’ or ‘it is an insignificant investment for you now’ or anything. This reflects how you manage your investments overall and indeed the careful or contemptible way in which you manage your clients’ money.

So I saw a chunky deal (in share number terms) go through the market and then a little while later, another one. And do you know what happened? The reported price was a steal – a third of the selling price the week before. The lucky market maker has since shifted all the shares making up to 160% profit from that little speculation. Now I ask. We are small fry, managing just over £205million but why do we all sometimes hold the big guys in such awe when they don’t care about these sorts of things? We are not perfect but when we deal, we do our utmost to do the best for our investors, even down to every last deal. What is sad is that other than the longer term superior outcomes, our better efforts aren’t reflected in ‘anything’ – comparative costs are still the same on banal ‘costs and charges’ summaries we have to send out, the product charges are the same, the ‘Total Expense Ratios’ the same and so it goes on. The fact we may add real, whole extra percentages to clients’ outcomes because we care to do the job to the best of our abilities isn’t shown anywhere and the fools who ‘know the price of anything and the value of nothing’… well, there’s no convincing them (even the well-intended but naïve Regulator on this front), is there! And the name of this institutional seller (one for whom otherwise I had had great respect but it shows a lot…)… I can reveal later! As for 2020/21, we have saved enough and made enough for all our clients to pay a lifetime of all their fees.

Tech Favourites – Shenanigans

Investors have had a rude awakening to Scottish Mortgage Trust which has been hit hard by the profit-taking over the last several months. It did fantastically and Baillie Gifford’s overall success in the Tech space is very commendable. They have some great people there with integrity too but is it time to exit? Investors have suddenly realised that unquoted holdings can be great – or impossible to value – and suspicious. The once darling of all trend-following private investors had a punch on the nose. They may have forgotten that the Company also has borrowings so when things go well, it makes an extra profit on the loans but when they go badly, it loses investors’ money as well as extra on the loaned funds. The Company has been buying-in its own loose stock too – not a bad idea (it can do so at a discount with the hope of reselling at a premium) but of course the more it owns of ‘itself’ the higher the gearing (loans to value) and the more concentrated the portfolio.

Then, what has Manchester & London Investment Trust been doing, asks the Daily Telegraph as it tells investors to sell? It’s almost uniquely tech and hasn’t performed this last year in line with its holdings because the Manager sold options to produce the income, so it hasn’t enjoyed the returns it could have had… now the majority of investors will say ‘Eh’? And I’d say, there’s nothing wrong with that but do you really know what you are doing and what you are buying? And excuse me, Daily Telegraph but why didn’t you note this when you were pushing the Trust as a great one to buy? The L&M chaps are also fellows for whom I have much time and respect but we don’t own any and won’t be either.

Indeed, we are quite fearful that too many investors all have the same trendy stuff – another sure-fire sign that a bubble is there and something is likely to happen. When we have new investors keen to do their own thing and they instruct us to buy (execution only of course) exactly the same stuff as we know they have seen at the top of the performance charts (that’s yesterday’s results, not tomorrow’s), we know something’s going to blow. They are probably all the same ones who would have been buying Peter Young’s Morgan Grenfell Fund, Neil Woodford’s portfolios or Invesco’s European Growth Fund from the 1980s or the 1990s. Of course, I could go on… there are loads…

Throwing Money At Business Start-Ups

I touched upon some of the cut-price investment product offerings recently and mentioned ten-year-old loss-making Nutmeg (often the most advertised one!) recently and wondered how viable they are. I fear that for many of them, the plot is lost as they are not covering their costs and there is only so much seed capital you can justify throwing at something and if it still isn’t beginning to pay… you have to call it a day. So, when they do decide to close-down or sell-out, investors thinking they have bought a ‘cheap’ investment management option suddenly find the costs and administrative hassle of interrupted service and moving ship as the new guys sell everything, buy something else or administrators assessing the processes and bureaucracy then stopping client access for a time whilst all that happens and hey presto, so much for ‘cheap’. Of course I am not challenging their stability and financial backing at all, for any of these.

Often the offering is actually pretty poor with no real adviser to talk-to when you might need too. Recently ‘Netwealth’ raised more money from initial investors so it has raised £38million in its five year history and only turned-over a miserly £475,000 last year, making a whopping £5million annual loss – is this a vanity project for the unquestionably nice and experienced people at the top? On that basis, PJM&CoPLC would have a value of about £240million! There is one serious difference though, we have much more under management than them and we are profitable and always have been… reassuring staff and clients alike that we are going to still be there in five years’ time!

Now I see ‘PensionBee is floating too. Only set-up in 2014 and ‘going to be worth’ £350million… So, let’s get this right… its revenue last year was just over twice ours but it made £13million losses. It expects to be breakeven in 2023. This float might make the founder ‘£157million’ but am I really missing something with all of these entities? Should I float PJM&Co Plc for a valuation of £300million, as not only have we been going for so much longer but we are consistently profitable? (This is real people’s real money we are talking about looking after here and not some tradeable commodity for onsale at a whim after five minutes so the answer is ‘no’). Maybe we need our business to lose £13million a year to warrant such heady valuations…

The other ‘platforms’? We are often transferring from them and have very mixed experiences… it has been very busy for many but a transfer of an ISA from Hargreaves Lansdown which started in November only materialised in February despite our regular chasing! Most don’t allow you to trade everything on the market either so some of the best opportunities we see for our clients (and can buy) are just not there for investors either because you aren’t deemed ‘sophisticated enough’ or because trading is well, too difficult. We also use the intermediary’s channel ‘Transact’ a little but it can’t match our bespoke systems and is infuriating when we want to deal and at prices we want and expect to secure. It is also very restrictive in some regards as to what is ‘allowed’ according to what the underlying ‘product’ is – some of this is a ‘lack of understanding’. I suppose for us, a small, dynamic investment manager, it means the pricing anomalies are and will be even better as others can’t can buy or hold the very things offering us the best outcomes.

Risk Warning

Stock market investments can offer income through the payment of dividends and interest and good opportunities for capital appreciation over the longer term. By this, generally we mean periods in excess of five years, preferably much longer. However, we can never promise you particular returns, especially in the short-term. At any point in time but especially in the short term, your capital could be worth less than the original amount invested as some of the selected holdings may fall in value, regardless of expectations at the time of acquisition. We may also invest in funds that hold overseas securities. The value of these investments may increase or decrease as a result of changes in currency exchange rates. Returns achieved in the past cannot be relied upon to be repeated.

To remind you, why do I send out occasional emails? Because everyone can save money. We have no connection with any companies mentioned and you have to make your own contacts and satisfy your own enquiries. What is in it for us? If we can prove that we are knowledgeable and that our service and advice have good value, then you might contact us for professional financial planning and investment help. You don’t have to do that though and there’s no charge for emails. If simply they save you money, then accept them with our compliments! However, you’ll know where we are!

If you have any queries of any form or indeed any subjects you think I could include, please contact me. I also refer you to our website www.miltonpj.net. We celebrate our 35th anniversary in 2020 and have been publishing a well-respected independent column in the local Paper for most of that time and free client newsletters as well.

Do not forget however the usual caveats – this is not ‘advice’ and you are encouraged to seek that before embarking upon any financial route involving investments, etc.

My best wishes

Philip J Milton DipFS CFPCM Chartered MCSI FPFS FCIB

Chartered Wealth Manager

Fellow Of The Personal Finance Society, Fellow Of The Chartered Institute Of Bankers