Following-on from the last piece on this subject, it was good to see that a Company has been compulsorily wound-up. Asset Backed Management Ltd was taking a 40% ‘commission’ for selling others’ bonds to investors. This was similar to the LCF disgrace where Paul Careless’ company was taking 25% of each £1’s worth of bond sold. ‘The Capital Bridge’ was still using the LCF agency’s companies and paying commissions of that ilk and despite the taint from that fall-out and what is so sad is that the Regulator, which has been accused of being dilatory in its actions over LCF, has been allowing this sort of behaviour to continue. Whilst there is a case of ‘why are people so stupid’ (sorry to be so blunt) but also the Regulatory framework has to be expedient to act swiftly when it becomes aware of unacceptable practices like this and also fraud. In our naïve eyes it is not rocket science to act quickly and decisively. https://www.standard.co.uk/business/revealed-lcf-agent-still-pulling-in-big-fees-from-highrisk-bonds-a4115246.html. Thank you Peter E for reminding us of this one!

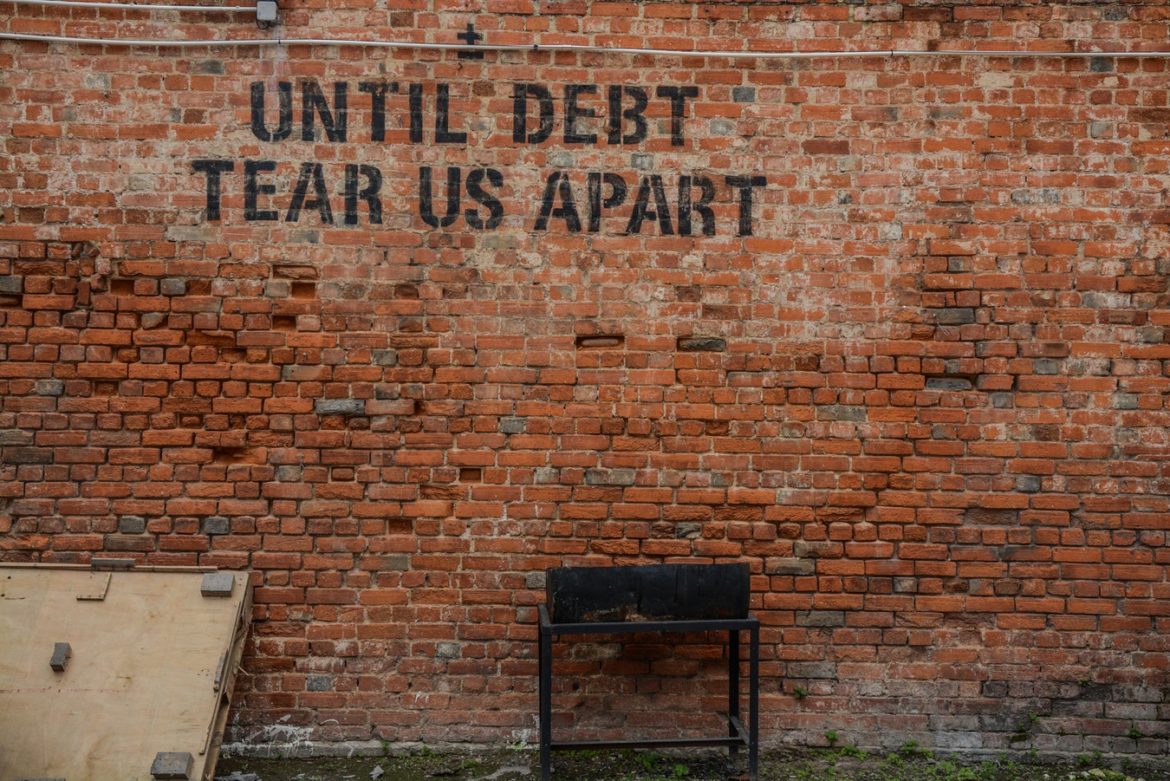

I am indebted (!) to Mr Andrew McNally of Equitile Investors for a copy of his book, ‘Debtonator’ when he visited to share breakfast with me. It was a pleasure meeting him and chatting over some concepts too and our histories go back over the years, sharing some of the industry’s experiences and names, in different guises. First, it is only a small tome but I commend it to you. It is well written and simple to follow but shares some of the basic concepts of debt and also equity investing and endeavouring to ‘debunk’ some of the silly myths surrounding both.

I am sure that we all agree that in life we seek the concepts of justice, equality, conformity and fairness though naturally we may have different ideas for attaining that. These principles are from the Latin word ‘aequitas’ from which we have the word ‘equity’. One of the obvious principles with which I agree seems to have been forgotten (after being discovered again in the eighties and nineties) is the one of a share-owning democracy – from ‘telling Sid’ to the privatisation of myriad industries in our Country. The Left has tried to purloin it and to make the principle a dirty one of exploitation but actually what it points towards is the ONLY way of sharing our economic growth with our people and our Society. If we do not have economic progression, we do not have any progression in standards and conditions so what better way for people to participate in that, by being co-owners of the very equity which progresses as it reflects that growth?

Of course there are ups and downs and you need to be wise and spread your eggs around but we do that in our normal daily lives so it shouldn’t be as strange as the regulators and so on make out. It’s really not the risk of capital values gyrating which in the end is the biggest risk but the risks of failing to participate in ‘Equity’ at all or to a sufficient extent. ‘Equity’, as Andrew says, is the route to participation in our economic progress, bringing “stability, trust, optimism and a greater sense of fairness”. Putting your money in an inanimate object called ‘your home’ may be sound but it should not be an ‘investment’ as it is not generating any economic growth, just capital appreciation which in the end will lead to significant capital destruction from over-inflated levels too (and it costs an arm and a leg to keep it!). Leaving your money on deposit long-term doesn’t help either – whether with the government or banks and building societies as that money is being used to lend to others who then profit from the equity it produces and you will see inflation gobble-up your money over time.

The book also referred to the present excessive exposure to debt to finance the future, rather than using equity. Of course, debt is one of the surest ways of increasing your wealth but it comes with risks and costs so it needs careful management and not excessive exposure. I am reminded of a now passed-away very elderly friend who acquired some South Coast and London hotels after she demobbed after the war – how did you make your fortune you may have asked? ‘Aah – OPM’ she said. ‘Other peoples’ money’.

So, stop being deterred and make sure that at least some of your money is placed in ‘equity’ so you can begin to participate in the long-term economic growth and prosperity which our economic world will keep producing and remember, if you step on board when things are artificially cheap, perhaps such as at the moment, you give yourself a head start for the future. You can do this monthly or in lump sums and through a wide variety of different receptacles from ISA to pension for example. Just do it!

I am pleased to say that the sale and management of these things will soon be regulated. I have been pressing for this for some time as there has been a number of poor practices and unsatisfactory protection if things went wrong. How these will be regulated is another matter and hopefully the removal of commission for their sale, to match other financial products, will be one conclusion. Demanding too that the vendor has some basic qualifications has to be imperative and protections for the ‘pot’ whereas at the moment the provisions are inadequate to say the least.

I do not gloat that Mr Woodford has been forced to suspend withdrawals from his leading Unit Trust. Whilst we never had any exposure to it, for ‘other’ reasons, we do have some limited exposure to some of the direct stocks which he owns too and those have been sold-off in sympathy as holders anticipate these will be the sorts of shares that the funds will need to realise to meet the requests for redemptions, thus making the outcome even poorer for his holders. It must be very stressful for the fund managers and especially so when they are forced to sell things that really they don’t want to sell too – at this moment in time.

There becomes a point, however, when if a company’s share price hits a particularly low level that the whole company becomes a worthwhile target for a predator or indeed for the company itself to ‘do something about it’. Of course, if there are high levels of borrowings its options may be limited but still, the best investment they make could be to mop-up the artificially supressed stock and thus using other shareholders’ capital wisely and exaggerating the future returns for them – a smaller number of shareholders remaining. It would help Mr Woodford if some ‘good news’ arose though sadly with the ongoing procrastination over Brexit, UK-centric shares have fewer followers as prospective investors sit on the side-lines waiting till they perceive they know how the future is looking so they can make better informed decisions.

As for us, as independent discretionary investment managers too, (the Woodford reputational damage noted and as long as there is not any excessive ‘silly’ contagion from this separate beast) we may well now add Woodford Patient Capital Investment Trust shares to clients’ holdings. The discount to the underlying net asset value is now extreme and the Trust doesn’t suffer the same pressure as those wanting their money out but who have to sell their shares to another buyer. Perhaps Mr Woodford should look to convert his Equity Income Trust into an Investment Trust to take-on all the underlying investments – that would also create an instant uplift in value as those major shareholdings wouldn’t have to be dumped on the market after all and there would be an instant recovery from this point. Indeed, it is interesting too that holders like Kent County Council’s liquidation will create the worst possible value for it by exiting – never a good reason for not doing something but the unit value achieved will be lower as a consequence of its own instructions. Maybe there could be some dynamic arbitrageurs out there with the odd billion or two who could orchestrate some options against major positions and take on the portfolio – that would catch the market (and the short-selling vultures out to profit from the ill wind) unawares…

There are some wider warnings here though not many will realise them. It is the impact of a star fund manager having a hard time and trends moving against them and then the consequences – and of course too the same could be said for over-hyped sectors when the sentiment changes. Woodford Investment Management is presently quite ‘small’ in the scale of things compared to some other ‘popular’ investment managers and index funds. When, or if, their times in the sun come to an end, the carnage could be immense and especially as so many of the recent stars have all followed the same principles and buying the same sort of modern tech stuff. Fundsmith et al could all then find they are holding all the sort of shares that suddenly no-one wants any more and they are selling to a market which doesn’t want it. The sums involved then would be significant and the possible market moves considerable and you’d want to be holding the sorts of smaller stocks which Mr Woodford favours as typically they have a traditional ‘value’ bent and at the end of the day, even after a profit warning a company like Kier Group Plc should still be there delivering infrastructure projects at a profit – with emphasis on the word ‘should’. Maybe Mr Woodford’s unfortunate clarion call is a good reason to sell some of this ‘growth’ stuff to buy Mr Woodford and his types of stocks after all.

The regulator is going to introduce new rules which limit the amount any individual can invest without advice, to 10% of their capital. This is on the back of the implosion in ‘Lendy’ – which had a growing range of debt repayment issues from bad customers so that investors will suffer thumping losses. As you will know, we are still fearful. There are many out there and they promote ‘security’ over the underlying project but if the Property market wobbles and the development you have supported goes bad, that security could soon become worthless. In many regards you are better buying the shares of quoted P2P lenders instead – buying the greatest diversity and holding liquid assets which you can sell – rather than finding your deposits are with unsaleable assets when things go bad and wrong. I’ve even been looking at Funding Circle Plc since it floated (the shares having drifted some way since then) as a better option perhaps than lending on the Company’s platforms instead!

I did not imagine that when I noted how cheap the price of wheat had been (1 May) that there would be such a surge in value almost straight afterwards (circa 20%). It is ‘sort-of’ connected with trading tensions but weather has something to say as well as stocks held of course but still, the acute volatility is not helpful. The rise could be inflationary in due time though it is almost matched Dollar for Dollar in the reduction in the oil price – Brent Crude is now off over 20% since its recent high. I think that what it is endorsing is that it pays to have a diversified portfolio of ‘defensive’ assets and even when things like wheat are very cheap compared to long-term norms, they are worth considering over purely financial instruments (perhaps especially when German bonds plumb their highest ever levels – at rates the ‘worst’ since the EU was created and at minus 0.18% for ten year bonds – the lowest in 700 years (well for ever). This artificiality is a reverse Ponzi scheme and it will unwind at some point.

RISK WARNING

Stock market investments can offer income through the payment of dividends and interest and good opportunities for capital appreciation over the longer term. By this, generally we mean periods in excess of five years, preferably much longer. However, we can never promise you particular returns, especially in the short-term. At any point in time but especially in the short term, your capital could be worth less than the original amount invested as some of the selected holdings may fall in value, regardless of expectations at the time of acquisition. We may also invest in funds that hold overseas securities. The value of these investments may increase or decrease as a result of changes in currency exchange rates. Returns achieved in the past cannot be relied upon to be repeated.

To remind you, why do I send out occasional emails? Because everyone can save money. We have no connection with any companies mentioned and you have to make your own contacts and satisfy your own enquiries. What is in it for us? If we can prove that we are knowledgeable and that our service and advice have good value, then you might contact us for professional financial planning and investment help. You don’t have to do that though and there’s no charge for emails. If simply they save you money, then accept them with our compliments! However, you’ll know where we are!

If you have any queries of any form or indeed any subjects you think I could include, please contact me. I also refer you to our website www.miltonpj.net. We celebrated our thirtieth anniversary in 2015 and have been publishing a well-respected independent column in the local Paper for most of that time and free client newsletters as well.

Do not forget however the usual caveats – this is not ‘advice’ and you are encouraged to seek that before embarking upon any financial route involving investments, etc.

My best wishes

Philip J Milton Dips CFPCM Chartered MCSI FPFS FCIB

Chartered Wealth Manager

Fellow Of The Personal Finance Society, Fellow Of The Chartered Institute Of Bankers