Market news and investment

Meta and Microsoft both topped analysts’ expectations for latest quarter’s results at the same time the US economy suffered a regression of 0.3% in the first quarter’s ‘growth’ – apparently nothing whatsoever to do with President Trump of course and his actions of late.

Gold has come-off its top – an over-extended spike it might...

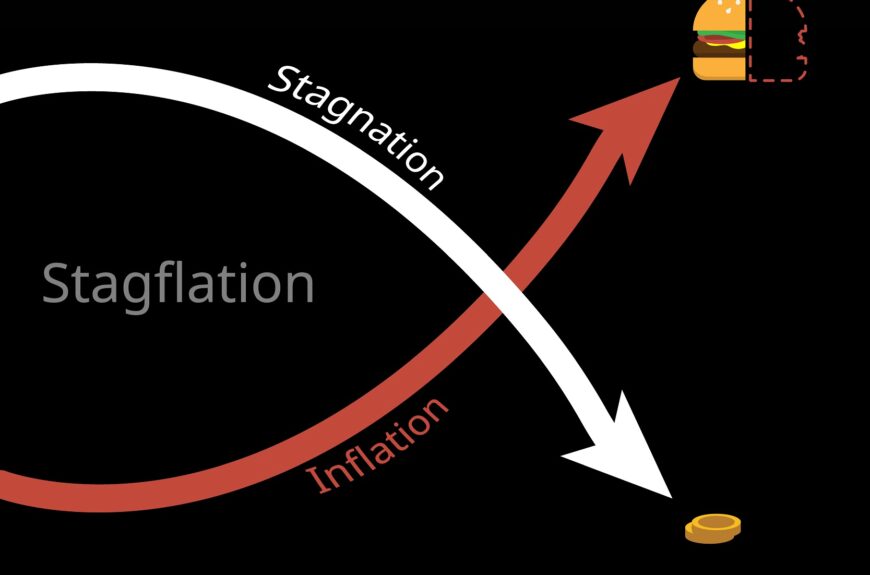

Is ‘stagflation’ looming and what can you do about it?

Interest rates have been cut to 4.5% as expected but with low economic growth, higher unemployment and price rises, some analysts fear we are heading for a period of ‘stagflation’.

First coined in the 1960s, the term simply means economic stagnation on the one hand and inflation on the other, which is neither beneficial to...

What will Inheritance Tax changes mean for farmers and the rest of us?

Farming is a huge part of life for many here in North Devon and there is growing concern at the Government’s decision to change Inheritance Tax rules for farmers (and others in business).

Shortly we shall be writing to clients to clarify some of the changes in the recent Budget from Chancellor Rachel Reeves and...

Are you losing money to your ‘savings’ account?

Shocking recent figures have shown that more than 250,000 adult cash savings accounts with £10,000 and above deposited in them are earning 1% or less.

This is despite a growth in savings rates and relatively high interest rates over the past two years and frankly it shouldn’t still be happening, but it is.

We typically aim...

Oil prices and energy concerns

Good afternoon. Along with Mr Felix Milton, I have just returned from an encouraging and helpful conference with ACFA – I have not been for a few years so it was a good and worthwhile event to recharge batteries.

We were reminded of the value of the advice and service which a good financial adviser...

Who needs financial advice? Can you afford not to?

There was a timely reminder of the invaluable advisory and guidance interactions we have with so many of our clients when two senior investment professionals noted they too have advisers, when many might assume they ‘can’t need them’.

Perhaps we don’t blow our own trumpet enough in reminding clients how valuable our assistance to them...

Interest rates and investment trusts

Don’t become an ‘advice gap’ statistic and lose out

We’ve talked before of the dubious choice of investors trying to ‘go it alone’ and of the value of sound independent advice across all manner of financial needs.

So it is worrying that the numbers of people who sought financial advice last year dropped to only 9% apparently, a drop of 18% on the year.

Research...

Regulation is well-intended but is it pushing some advisors to the brink?

People do not necessarily consider financial services from the other side of the desk – and of course, why should they? They turn up at the office of an Independent Financial Adviser (IFA) seeking advice and answers for their specific situation.

But we thought it might be helpful to share some insights into the effects...