Volatile US stocks

Volatility led by the US has escalated quite dramatically. It's impacted market values – especially some US tech cos and Nasdaq has drifted 10% now but the concerns over tariffs and the Ukraine situation and the US reaction to it, let alone clumsy politics and diplomacy, have not helped. Suddenly Nvidia and Tesla aren't...

What does US inflation mean for the UK?

Inflation in the United States rose more than expected last month to 3% - exactly the same rate as here in the UK, funnily enough!

‘Unpredictable’ best describes the start of Donald Trump’s presidency as his proposed tariffs on imported goods look likely to push up prices for American consumers.

The rate of inflation ‘over there’...

Off-piste, risk and the economy

Having grabbed a week to visit Chamonix and on one day to travel up to Aiguille du Midi (3,842 metres) to view Mont Blanc (4,805metres), gave me an opportunity to see ‘risk’ in a different context. The height, the highest I have ever been excluding flights, puts risk in a different perspective altogether

The engineering...

Are Cash ISAs under threat from the Chancellor?

Regular readers of this column will know we are not entirely (or certainly not universally) in favour of Cash ISAs simply because the balance of interest rates versus inflation means you can effectively be ‘losing’ money by having many thousands sat in an ISA ‘doing nothing’ as well as letting inflation eat it away.

Saving...

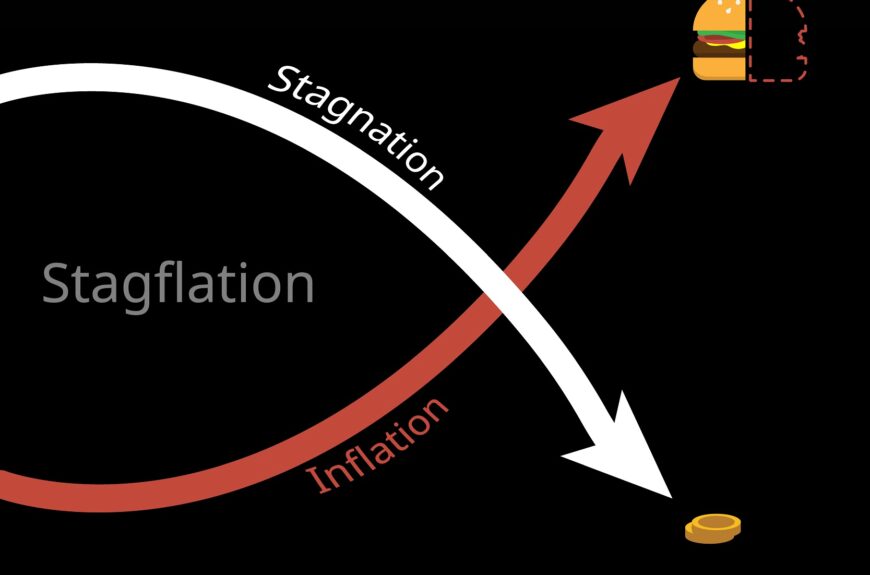

Is ‘stagflation’ looming and what can you do about it?

Interest rates have been cut to 4.5% as expected but with low economic growth, higher unemployment and price rises, some analysts fear we are heading for a period of ‘stagflation’.

First coined in the 1960s, the term simply means economic stagnation on the one hand and inflation on the other, which is neither beneficial to...

Good value, gold and Blackstone

Good afternoon. We hear BP may be in play as Elliott Investors in the US has accumulated a stake in one of our biggest companies. It’s ridiculously good value regardless and hasn’t kept up with other energy stocks. Meantime, our funds under management see yet new heights which is good, as many deep value...

Trump inauguration and UK economy

Well, despite record low temperatures for a presidential inauguration so the event is moved inside, over here spring is in the air with new bird song, Albert the Peacock’s beautiful train almost complete, bulbs are showing and snow drops are emerging. Let us hope for good things to come and a great summer!

In the...